What Happens to a Bank Account When Someone Dies in Florida?

When someone dies, managing their bank accounts and other assets is one of the most urgent tasks for surviving family members. In Florida, what happens next depends on the type of account, whether a beneficiary was named, and whether the deceased had a will or trust in place. This guide explains the different scenarios and legal steps involved in accessing and distributing bank funds after death.

A deceased person’s bank account is subject to Florida probate law, state statutes, and specific bank requirements. Understanding these processes is crucial for heirs and personal representatives. When a person passes away, their financial affairs, including bank accounts, must be managed and distributed according to estate planning and probate laws. The fate of a bank account depends on several factors, including ownership type, beneficiary designations, and whether probate is required.

Understanding how the account was structured is key to determining what steps are needed and how quickly heirs or beneficiaries can access funds. Financial institutions play an essential role in managing the deceased person’s accounts, following legal procedures and beneficiary instructions. An experienced probate attorney can guide you through closing a deceased person’s bank account and handling their financial affairs. Proper estate planning can simplify the process and even help avoid probate altogether.

Introduction to a Deceased Person’s Bank Account

When a loved one passes away, their bank account becomes part of the estate and must be managed and distributed according to their wishes or, if no estate plan exists, in accordance with state law. For family members, personal representatives, and beneficiaries, understanding what happens to the deceased’s bank account is essential to ensure a smooth transfer of assets.

In Florida, the probate process determines how a deceased person’s bank account is handled, depending on the account type, beneficiary designations, and any joint ownership. Personal representatives play a key role in managing these accounts, and working with a Florida probate attorney can help navigate the complexities of probate. By understanding the rules around beneficiary designations and probate requirements, families can ensure funds are distributed properly and in compliance with Florida law.

Claudette Bush

I’d been putting off my will and medical directives forever. A friend recommended RTRLAW, and I’m glad I finally made the call. Shawn Smith was incredible; kind, patient, and thorough. We knocked everything out in two meetings, and he made sure I understood every document. I feel at peace knowing my family’s protected.

Types of Bank Accounts

Bank accounts come in several forms, each with its own rules regarding what happens after the account holder’s death.

- Joint Accounts: Shared by two or more people; typically, the surviving account holder automatically inherits the funds, avoiding probate.

- Payable-on-Death (POD) Accounts: Also known as transfer-on-death accounts, they allow the account holder to name a beneficiary who receives funds directly upon death, bypassing probate.

- Sole-Owner Accounts: Held by one individual and usually subject to probate before funds can be distributed.

To access funds from a sole-owned account, a court-appointed personal representative must provide legal documentation to the bank. Understanding an account’s ownership type is crucial for determining how funds will be managed and who will have access after death.

Do Joint Bank Accounts Automatically Go to the Survivor?

Joint accounts with the right of survivorship automatically transfer to the surviving account holder, completely avoiding probate. The surviving owner must typically present proof of identity and a certified death certificate to gain access to the funds.

However, not all joint accounts include survivorship rights. Some are structured as “tenants in common,” which do not transfer ownership automatically. Additionally, even joint accounts may be subject to creditor claims if the deceased had outstanding debts. Using joint accounts as a replacement for a complete estate plan can also have unintended tax or inheritance consequences.

What Is a Payable-on-Death (POD) Bank Account?

A payable-on-death account allows the account owner to name a beneficiary who inherits funds directly upon their death, bypassing probate. Once the bank receives the death certificate and identification, the funds are released to the named beneficiary.

Beneficiary designations on these accounts override will provisions, making this a simple estate planning tool. However, it’s crucial to update designations regularly after major life events such as marriage, divorce, or the birth of a child to prevent outdated beneficiaries from inheriting funds. If a beneficiary is a minor, a guardian must manage the funds until the child reaches legal age.

If the Deceased Had an Individual Account With No Beneficiaries

An individually owned account with no named beneficiary typically becomes part of the probate estate. Formal probate administration is required for estates valued over $75,000 or when real property is involved. Smaller estates may qualify for summary administration, a simplified process.

Once debts are paid, the remaining funds are distributed according to the will or, if none exists, Florida’s intestacy laws (Florida Statutes § 732.101–732.111). Although Florida does not have a state inheritance tax, federal estate taxes may apply to large estates. Because probate can be lengthy and costly, many people use estate planning strategies such as POD accounts or trusts to avoid it.

Do Bank Accounts in a Trust Avoid Probate?

Yes. Bank accounts and other digital assets held in a trust are managed and distributed according to the terms of the trust, not through probate. Upon the account holder’s death, the trustee takes control and distributes the funds as instructed.

Trusts help maintain privacy, avoid probate, and allow customized asset distribution, such as ongoing support for dependents or staged disbursements. A well-structured estate plan that includes wills, trusts, and updated beneficiary designations ensures efficient and private asset transfer.

Bank Account Freezes

When a bank is notified of an account holder’s death, it typically freezes the account to prevent unauthorized transactions and protect estate assets. The freeze remains until the bank receives the required documents, such as a certified death certificate and letters of administration. This process safeguards the funds and ensures lawful distribution under Florida probate law.

What Happens if the Deceased Died Without a Will?

If someone dies intestate (without a will), and the account isn’t jointly held or doesn’t have a beneficiary, the funds must go through probate. Florida’s intestacy laws determine how assets are distributed, generally prioritizing the surviving spouse and children. The court appoints a personal representative, often a spouse or adult child, to manage the estate, settle debts, and distribute assets per state law.

Without clear estate planning, this process can be delayed and lead to family disputes, underscoring the importance of having a valid will or using estate planning tools like trusts and POD accounts.

What If Your Spouse Dies and You Don’t Have Access to Their Account?

If your spouse dies and you aren’t a joint owner or POD beneficiary, you typically cannot access the account until probate begins. While surviving spouses have rights to certain estate property, they may experience delays in accessing bank funds until a court appoints a personal representative.

To prevent this situation, spouses should consider joint ownership, naming each other as POD beneficiaries, or using a trust. A probate attorney can also help initiate legal proceedings and secure temporary access to essential funds.

How to Claim a Deceased Person’s Bank Account

The process for claiming a deceased person’s bank account in Florida depends on the account type and whether probate is required:

- Locate Account Information: Identify all accounts through bank statements or direct inquiries.

- Determine if Probate Is Required: Executors or personal representatives may need court documentation, such as Letters of Administration.

- Gather Required Documents: Including a certified death certificate, personal identification, and any necessary probate paperwork.

- Contact the Bank: Follow the institution’s procedures for releasing or closing the account.

- File with Probate Court (if required): Obtain authorization before accessing funds.

A probate attorney can assist with document preparation and ensure compliance with Florida law.

Tax Implications of Inheriting Bank Accounts

Florida has no state inheritance tax, but federal estate taxes may apply to large estates. Outstanding debts and taxes must be paid before any distributions. Beneficiaries may owe income tax on certain accounts, such as retirement funds. Consulting a qualified tax professional or estate attorney can help minimize tax burdens and ensure compliance.

How to Avoid Probate and Protect Your Family

Although probate can take months and incur significant legal costs, several strategies can streamline asset transfer:

- Use POD Designations: Allow funds to pass directly to beneficiaries.

- Establish a Revocable Living Trust: Transfers assets privately and efficiently.

- Maintain Joint Accounts: Enables immediate access for a surviving spouse.

- Consider Summary Administration: Suitable for smaller estates under Florida law.

- Review and Update Estate Documents Regularly: Reflects current life circumstances and wishes.

Planning reduces stress for your family and ensures your assets are distributed as intended.

Professional Legal Assistance

A Florida probate attorney can provide guidance throughout the probate process, ensuring compliance with state laws and helping clients avoid unnecessary delays. Estate planning attorneys can create wills, trusts, and beneficiary designations tailored to your needs. With proper legal guidance, families can navigate complex probate matters smoothly and protect their financial future.

Conclusion

Managing a deceased person’s bank account in Florida requires a clear understanding of probate laws, account types, and beneficiary rules. By consulting a Florida probate attorney and engaging in proactive estate planning, individuals can simplify asset transfers, avoid probate where possible, and provide peace of mind to their loved ones.

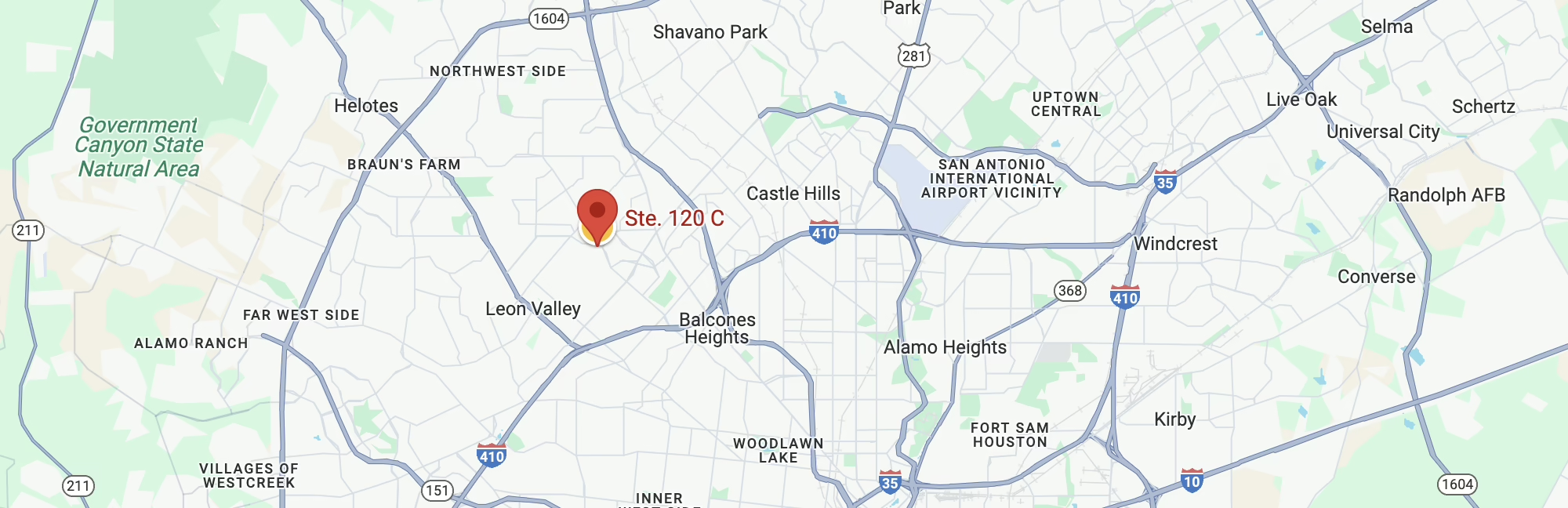

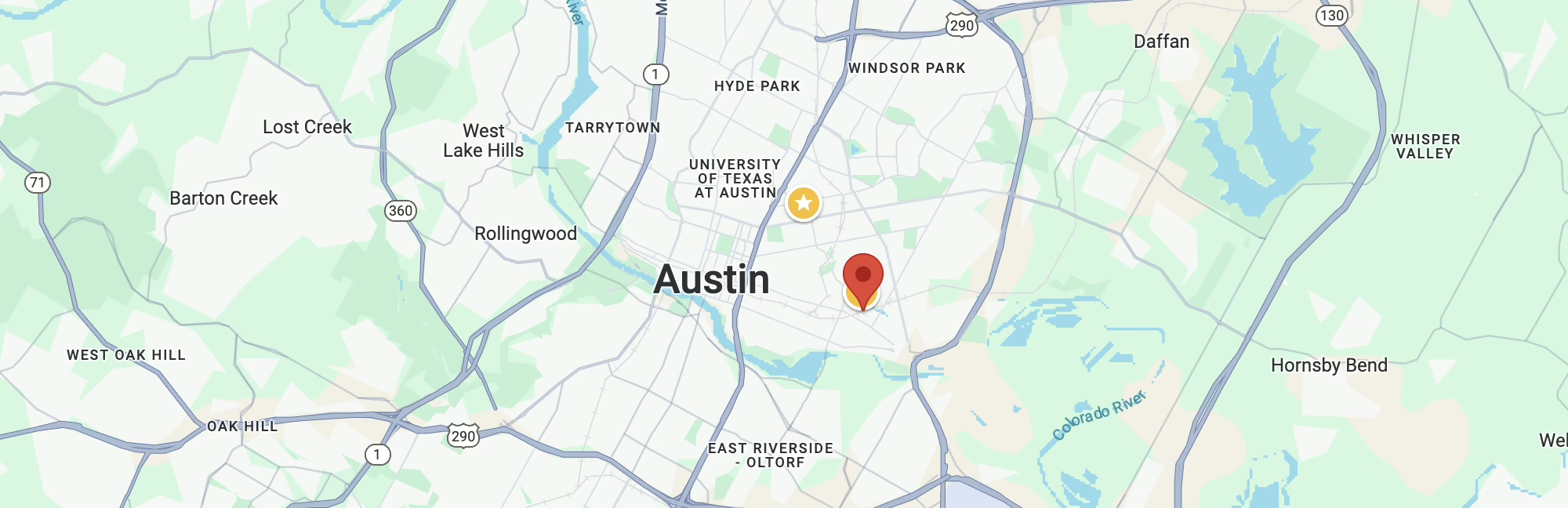

Call 1-833-HIRE-RTR or email [email protected] today for a free, no-obligation consultation.

CALL US NOW

CALL US NOW TEXT US NOW

TEXT US NOW