What is a Diminished Value Claim?

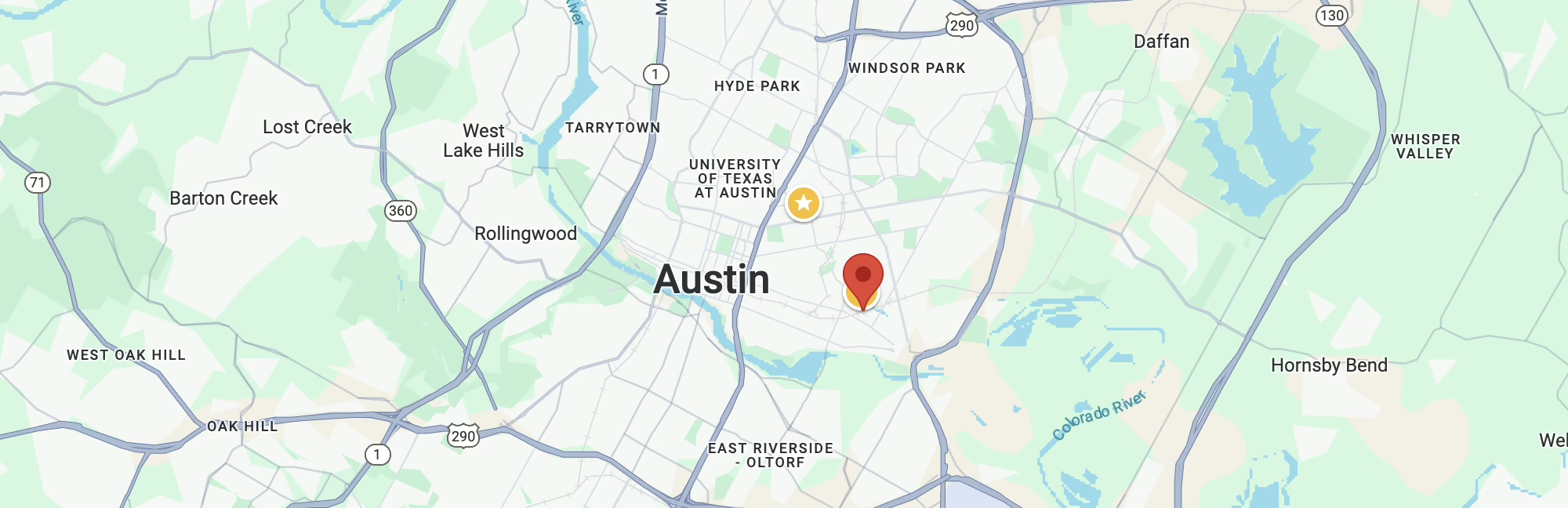

A diminished value claim is meant to reimburse the car owner for the difference in the car’s market value before and after the accident. However, both Florida and Texas law does not dictate that an insurance company is obligated to pay for the diminished value that occurred due to an accident in every instance.

Many buyers are cautious about purchasing a vehicle that has been repaired after an accident. For this reason, it can be difficult for people who repair their vehicles to try to sell them later.

Diminished value claims can be highly complicated and often require the skill of a knowledgeable attorney. If you need to file a diminished value claim, seek qualified legal representation, such as RTRLAW, immediately to understand your rights and explore your legal options.

How to File a Diminished Value Claim in Florida or Texas?

Filing a diminished value claim in Florida or Texas involves several key steps to establish your right to compensation for the reduced market value of your vehicle following an accident. Here’s how to proceed:

- Notify the Insurance Company: Contact the insurance company of the at-fault driver to inform them of your intent to file a property damage and diminished value claim.

- Repairs: Take your car to a trusted body shop and have them repair your vehicle and give them the property damage claim number that you obtained from the at-fault driver’s insurance company.

- Determine the Vehicle’s Pre-Accident Value: Establish your vehicle’s market value prior to the accident through appraisal or by using reliable car valuation tools.

- Document the Reduced Value: Obtain a professional appraisal to determine the post-repair value of your car, which reflects its diminished value

- Engage Legal Assistance: Consult with a knowledgeable attorney who specializes in such claims to navigate the complexities of the legal process and ensure your rights are protected.

- File the Claim: Submit your claim for Diminished Value to the at-fault party’s insurer, including all necessary documentation of the vehicle’s value loss.

Remember, you cannot file a diminished value claim if you are at fault for the accident. Additionally, in Florida, claims must be made within four years from the date of the accident to comply with Florida’s statute of limitations.

However, in Texas, claims must be made within two (2) years from the date of the accident to comply with Texas’ statute of limitations.

For personalized guidance and to discuss your specific situation, consider reaching out to legal professionals such as RTRLAW, who can provide expertise and support through the claims process.

Matthew Hite

After hurting my back at work, I contacted RTRLAW and worked with Attorney Matthew Sosonkin. He handled every part of my workers’ comp case so I could focus on recovering. Because of him, my payments started quickly and the stress dropped instantly. I’m grateful for how seriously he took my situation.

How Do I Initiate a Diminished Value Claim?

If you’ve been involved in an accident that wasn’t your fault and you believe you have a diminished value claim, you need to follow certain steps to establish that claim, including:

- Contacting the other driver’s insurance company and asking about the coverage they provide and how they handle diminished value claims.

- Establishing what the value of your vehicle was before the accident occurred.

- Having your vehicle appraised.

- Consulting an experienced attorney to learn more about your potential diminished value claim.

What Are the Different Types of Diminished Value Claims?

There are three different types of diminished value claims that can affect your car’s value. They are:

- Immediate diminished value: This refers to the difference in a car’s value before and after the accident occurs if the owner tried to sell the car immediately after the accident.

- Inherent diminished value: This refers to the car’s value before the accident and what it is worth after it has been repaired. The car’s accident history report will typically cause buyers to be cautious about buying a car that has been repaired after being involved in an accident.

- Repair-related diminished value: This refers to the reduced value of the car caused by the quality of repairs or parts used to fix the vehicle.

Can I Be At Fault For an Accident and File a Diminished Value Claim?

You can’t file a diminished value claim if you’re found to be at fault for a motor vehicle accident. In addition, by law, you’re not permitted to file a claim against your own insurance company for diminished value.

Nevertheless, if you’re not at fault for the accident, and your car suffers enough damage that ends in the vehicle losing value, you may be entitled to file a claim with the other driver’s insurance company.

How Long Do I Have to File a Diminished Value Claim?

In Florida, drivers have up to four years to file a diminished value claim against the other party’s insurance company, but, in Texas, drivers only have up to two (2) years to file their claim. Like any other legal proceedings subject to the statute of limitations, individuals should not delay in filing a claim.

If you wait too long to file a diminished value claim, vital evidence can be lost, witness memories may fade, and the value of your car will naturally diminish as time goes by. Even if you have a viable case, waiting too long can cause your claim to be denied.

If you have any questions about filing a diminished value claim, contact RTRLAW for a free, no-obligation case review with one of our legal team members who can answer your questions and explain your legal options. For more information, call RTRLAW toll free at 1-833-HIRE-RTR (1-833-447-3787).

Revision History:

- Feb 12, 2026 at 3:33 pm by RTRLAW (displayed above)

- Jan 13, 2026 at 7:01 am by victor

CALL US NOW

CALL US NOW TEXT US NOW

TEXT US NOW